This article may contain affiliate links.

Updated: May 6, 2025

Thailand is one of the most popular destinations right now, and it’s essential to be prepared for any unexpected situations. In this article, I’ll share everything you need to know about choosing the best travel insurance for Thailand, based on my own experience.

From why travel insurance for Thailand is necessary to how to find the best policy for your needs, you’ll find clear and useful answers to help you travel safely and worry-free.

If you don’t have time to read the entire article, the best travel insurance for Thailand is Heymondo—it’s also the one I personally use. Plus, with this link you get a 5% off.

Travel Insurance for Thailand

1. Do I Need Insurance to Travel to Thailand

Travel insurance for Thailand hasn’t been mandatory since October 2022, but it’s highly recommended. Medical care in the country is excellent, but costs can be extremely high if something serious happens and you have to pay out of pocket.

That’s why some governments, like Spain recommend «traveling in Thailand with medical insurance that offers the widest possible coverage.«.

A good insurance plan also covers other unexpected events like cancellations, lost or stolen luggage, or flight issues. So, if you want to travel with peace of mind, it’s best to get one.

You can travel cheaply in Thailand and save money in many ways, but insurance is not something to cut costs on. I say this from personal experience, having lived in the country and seen the struggles of tourists who travel without insurance and end up in an accident or with a health issue.

💲 Hospital Costs in Thailand

In Thailand, a simple medical consultation can cost just a few €/USD, even if you need to see a specialist. For example, I paid only €30 / 31 USD for a dermatologist visit, including the hospital fee and a couple of medications.

However, for anything serious, the costs are much higher—often in the thousands of €/USD.

To give you an idea, here are some prices:

- Hospitalization per day: Up to about 5,000 €/USD

- Surgery: Typically between 10,000 and 20,000 €/USD

- Medical repatriation: Up to €250,000/USD to Europe, even more to America.

Since costs are so high, Thai hospitals have started requiring upfront payment for serious accidents or illnesses if you don’t have international insurance. They will provide basic care, but if you need expensive treatment, you have to pay first.

👉 Where These Numbers Come From

If you’re wondering how accurate these prices are, they’re based on two recent cases:

- What my neighbor in Phuket had to pay for three surgeries and almost a month in the hospital after a minor motorbike accident. Luckily, her insurance covered everything.

- The case of Spanish traveler Ángela Agudo, who had an accident in Koh Tao in October 2024. Her situation was serious, and it made headlines because she had a budget insurance plan covering only up to €75,000. That amount was gone in just a few days, with hospital costs reaching €5,000 per day, two surgeries costing €20,000 each, plus a €250,000 repatriation.

2. How to Get Travel Insurance for Thailand

When choosing travel insurance for Thailand, there are several key factors to consider:

🔹 Insurance Provider

Choose a reliable company with experience in international travel insurance. Heymondo is one of the best options, offering excellent coverage and quick support. Plus, they specialize in travel insurance.

🔹 Coverage

It’s essential that your travel insurance for Thailand includes comprehensive medical coverage. Based on my experience, you should get a policy that covers at least 500,000 €/USD.

If you prefer to get just a health insurance for Thailand, make sure it also includes repatriation. This is crucial in case of a serious medical emergency.

If you’re planning to do adventure sports like climbing, hiking, or diving, your insurance should cover those activities as well. In Thailand, these activities often come with minimal insurance—or none at all.

If you choose travel insurance instead of just medical coverage, you’ll also be covered for theft, cancellations, liability, and legal assistance, among other things.

🔹 Upfront Payments

Some insurance companies require you to pay upfront and then request a reimbursement, which can take quite a while. This is common with the insurance offered by some bank cards.

The best option is a medical or travel insurance policy that covers expenses directly, so you don’t have to pay anything out of pocket. Heymondo takes care of everything from the start.

🔹 Contact & Assistance

Choose an insurer that offers 24/7 support with easy contact options like chat, phone, or email. Heymondo has an app with instant medical assistance.

🔹 Insurance Cost

The cost of travel insurance for Thailand depends on the length of your trip and the coverage you choose. Ideally, you should get a travel insurance policy with good coverage. While it’s slightly more expensive than basic medical insurance, the price difference is small compared to the extra protection you get.

On this website, you can check how much your insurance would cost with Heymondo—just enter your travel dates, departure country, and destination, and you’ll get an instant quote. Plus, booking through that link to get a 5% discount.

👉 In summary:

Before choosing your insurance, make sure it meets these key requirements:

✔️ Comprehensive medical coverage (at least 500,000 €/USD).

✔️ No upfront payments required for medical care.

✔️ Includes medical repatriation on emergencies.

✔️ 24/7 English-speaking support via app or phone.

3. Best Travel Insurance for Thailand

The best travel insurance for Thailand is Heymondo. This insurer offers excellent coverage for medical expenses, repatriation, accidents, and theft, along with 24/7 English-speaking assistance.

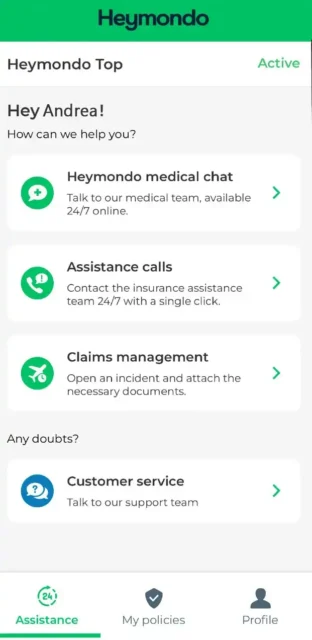

The best part? You don’t need to pay anything upfront for medical care—Heymondo handles the payments directly. Another big advantage is their app, which lets you access medical assistance from anywhere without needing to make phone calls.

Heymondo offers different types of insurance, but I recommend getting at least the "Heymondo Top" plan.

✅ Travel worry-free: Get your insurance here with a 5% off.

4. How to Use Travel Insurance in Thailand

If you get Heymondo insurance and download the app (screenshot below), you’ll have everything you need on your phone, including 24/7 direct contact and all your policy details, making it easy to manage any emergency.

🔹 Medical Assistance in Thailand

Whether you have a minor illness or a serious health issue like an accident, you can access medical assistance via chat anytime—quickly and without leaving your location.

The app also includes an emergency call option, which works just like a WhatsApp call. As long as you have internet access, you won’t need to worry about extra international call charges.

🔹 Other Incidents

For other issues like transportation delays or luggage problems, the app has a dedicated section where you can handle everything quickly and easily.

✔️ Travel with peace of mind: Get your insurance here with a 5% discount.

Final Thoughts

I hope this guide helps you choose the best travel insurance for Thailand, so you can find the right coverage for your needs and travel without worries.

In this guide to Thailand you can keep reading the main articles I’ve written about this beautiful country.

If you have any questions, leave me a comment below and I'll help you as much as I can. If you found the article useful, share it with other travelers. Have a good trip! 😘

More about Thailand

Hi, I’m Andrea, creator and author of Viajeros Activos (Active Travelers). I write about Southeast Asia, the Caucasus, and Europe. I’m a full-time traveler, passionate about good food, and always looking for new adventures.